Is it time for institutional investors to reclassify their relationship with third party asset managers? Are asset managers "simply" vendors, selling investment management products? As such, should asset managers be evaluated, systematically and objectively, within the discipline of supply chain risk management ("SCRM")?

Investing, particularly alternative asset investing, often remains a specialized, discreet process managed by subject matter specialists. Those professionals, in front and back offices, build relationships with the handful of "good" asset managers. Those "good" managers are scare, or so we are told, and relationships are often paramount to guarantee access and capacity. Indeed, a client told Castle Hall earlier this year that they were entirely comfortable with a private equity GP - and didn't need to conduct any due diligence on that manager - as they had "golfed with him" for more than 20 years. Other investors have expressed concern that if they "ask too many questions" they will be scaled back and lose capacity in "hot" PE raises.

Hmm.

Overall, however, the process to conduct initial due diligence, and then maintain ongoing oversight over third party asset managers, has become more systematic and more consistent. Many investors are subject to regulatory oversight, external and internal audit, Sarbanes Oxley and similar functional obligations. In other words, many asset owners are professional investing entities subject to normal, institutional control structures.

This has resulted in a number of key changes in the diligence process:

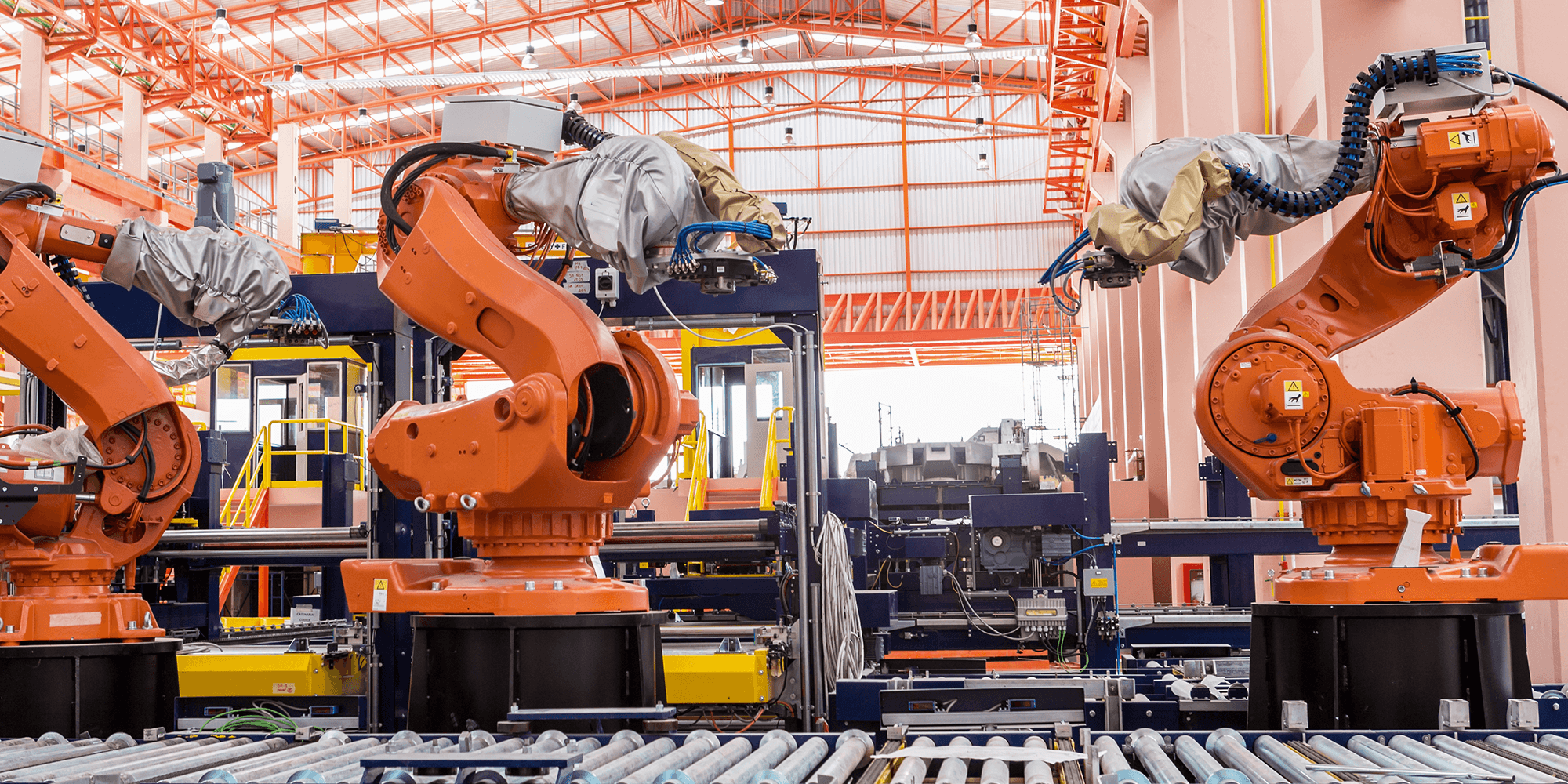

All of which raises a broader question - is it time to "demystify" the due diligence process, across both front and back office, and treat asset owning organizations like other corporations? Should we think about the process to engage and then oversee external asset managers similar to the way a manufacturing company - Apple, Tesla, Nike, GE - oversees their supply chain?

One leading supply chain textbook is "Supply Chain Risk Management: Vulnerability and Resilience in Logistics" by Donald Walters. This book defines the context and purpose of Supply Chain Risk Management (SCRM):

SCRM is responsible for all aspects of risk to the supply chain. Specifically, it ensures that principles established by senior managers are applied to logistics risk. So a reasonable starting point for SCRM has senior logistics managers analysing the organization’s overall risk strategy and identifying its requirements from logistics. Then they design their own long-term plans for risk in the supply chain – included in a supply chain risk strategy, which contains all the long-term goals, plans, policies, culture, resources, decisions and actions that relate to risks within a supply chain.

[These include:]

Montreal

1080 Côte du Beaver Hall, Suite 904

Montreal, QC

Canada, H2Z 1S8

+1-450-465-8880

Halifax

168 Hobsons Lake Drive Suite 301

Beechville, NS

Canada, B3S 0G4

Tel: +1 902 429 8880

Manila

10th Floor, Two Ecom Center

Mall of Asia Complex

Harbor Dr, Pasay, 1300 Metro Manila

Philippines

Sydney

Level 15 Grosvenor Place

225 George Street, Sydney NSW 2000

Australia

Tel: +61 (2) 8823 3370

Abu Dhabi

Floor No. 15 Al Sarab Tower,

Adgm Square,

Al Maryah Island, Abu Dhabi, UAE

Tel: +971 (2) 694 8510

Copyright © 2021 Entreprise Castle Hall Alternatives, Inc. All Rights Reserved.

Terms of Service and Privacy Policy