An overview of key areas to assess in a review of Audited Financial Statements

A fund’s financial statements represent foundational due diligence evidence, particularly for ongoing monitoring of existing investments. However, the review of audited financial statements (“AFS”) is a challenging due diligence obligation. The AFS review process is time compressed, the workload can be voluminous, and spreadsheets are inflexible and cumbersome as reporting tools. Above all, how does the diligence team validate and evidence that 80% of funds have no financial reporting issues - and then target in on the 20% where the financial statements could raise diligence issues?

This Due Diligence University Primer provides an overview of the different areas of AFS review. We hope that these comments help institutional investors enhance their due diligence programs when investing in hedge funds, private equity partnerships and long only funds.

This Due Diligence University Primer provides an overview of the different areas of AFS review. We hope that these comments help institutional investors enhance their due diligence programs when investing in hedge funds, private equity partnerships and long only funds.

This due diligence primer covers the following areas:

- Auditor

- Audit Opinion

- Accounting Framework

- Balance Sheet Analysis

- Portfolio Valuation

- Asset Flows & Shareholder / Partner Equity

- Income Analysis

- Fees & Expenses

- Other Expenses

- Notes to Financial Statements

Visit Castle Hall's Due Diligence University to download our Audited Financial Statements diligence primer and other resources, or contact us to learn how Castle Hall can help allocators build and implement risk-based due diligence policies and programs.

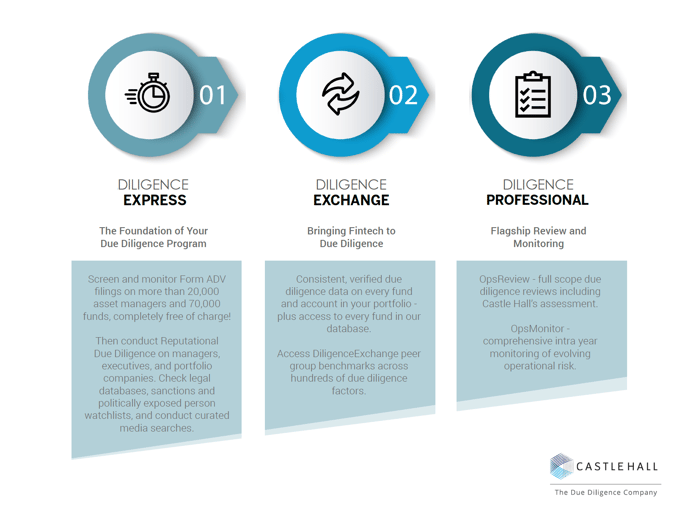

Learn more about Castle Halls 3 Steps to Effective Due Diligence.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.