The Manager Form ADV filing can support operational due diligence observations.

Financial market regulation creates the “rules of the road” for the asset management industry. In many jurisdictions, regulators publish extensive information about asset management companies, which creates a vital reference source for investor due diligence. What has an asset manager filed with the regulator and - often even more important - what has changed year on year?

In the United States, the Securities and Exchange Commission (the “SEC”) publishes data on more than 20,000 US and international asset managers based on information filed on the Form ADV, the “Uniform Application for Investment Adviser Registration”.

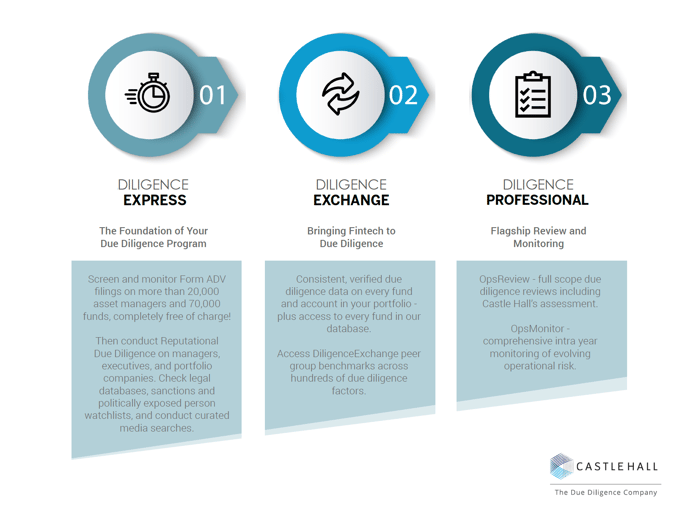

This primer considers how the Form ADV can help investors across the three stages of due diligence:

- How can investors use the ADV to complete rapid screening of potential investments?

- How can investors use the ADV to cross check and corroborate information provided by the asset manager when onboarding a new fund / account?

- How can the Form ADV support ongoing monitoring of existing investments?

Visit Castle Hall's Due Diligence University to download our Manager Form ADV diligence primer and other resources, or contact us to learn how Castle Hall can help allocators build and implement risk-based due diligence policies and programs.

Learn more about Castle Halls 3 Steps to Effective Due Diligence.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.