There is a new way to Due Diligence. Institutional due diligence programs now mandate active, risk adjusted diligence monitoring, across all external managers.

Castle Hall believes that due diligence is long overdue for a fintech makeover.

Every investor has higher value questions, specific to their organization, which influence their investment decision. But core diligence questions - the manager / GP's corporate structure, systems used, the compliance officer’s bio - are the same for all allocators. Multiple investors asking for the same information, but in slightly different ways, simply adds expense and delays the investment process for all sides.

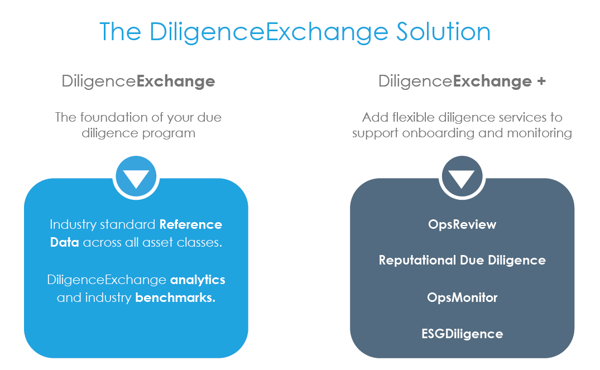

DiligenceExchange ("DXC") enables managers and investors to use the same framework to share core reference data, needed as the “first 50%” of every due diligence review, in a standard format.

For investors, DiligenceExchange provides consistent, independently verified due diligence, available for every manager and fund in a portfolio. For investment managers, Castle Hall saves time by enabling the manager to work with our diligence team on behalf of multiple investors.

DiligenceExchange

Industry Standard, Verified Due Diligence

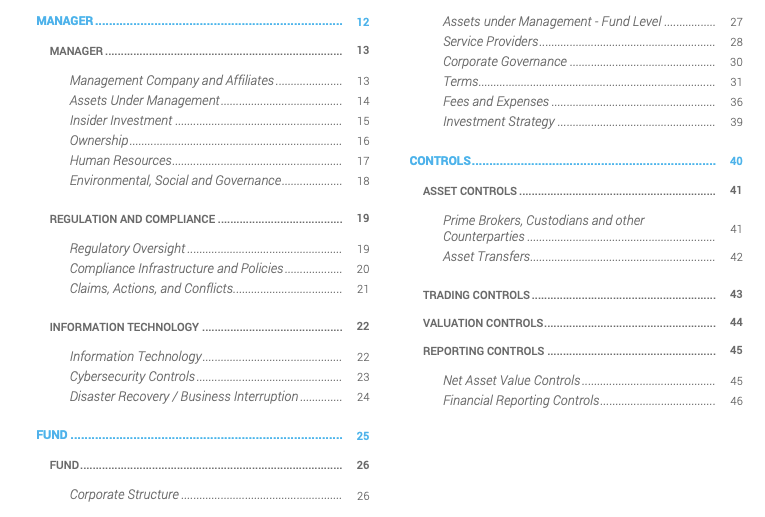

Each DiligenceExchange report presents key reference data across the investment manager, the fund and the manager’s control environment. DXC uses a standardized format, comparable across all funds and accounts.

fund and the manager’s control environment. DXC uses a standardized format, comparable across all funds and accounts.

DXC is not just another DDQ template. Castle Hall conducts our own due diligence work, including “trust but verify” anti-fraud checks such as service provider verifications.

Database and Benchmarks

DiligenceExchange (“DXC”) subscribers access our full database of nearly 1,500 managers and

2,000+ funds across all asset classes. Subscribers may also request unlimited new DXC reports to be added to the platform on any manager and fund.

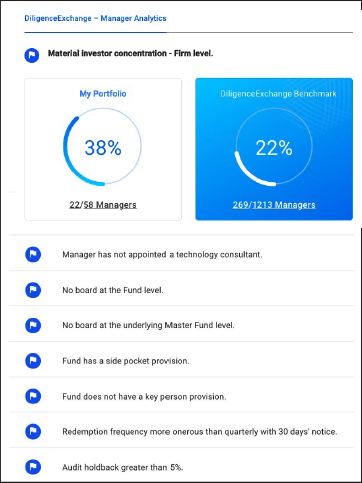

DXC Analytics

- At a fund level, each DXC report identifies risk analytics across 200 + flags.

- At a portfolio level, DXC Analytics allow investors to see the aggregate operational risk profile across all their managers and funds.

- DiligenceExchange Benchmarks aggregate our entire coverage universe. DXC Benchmarks bring long overdue transparency, enabling evidenced, data driven decision making.

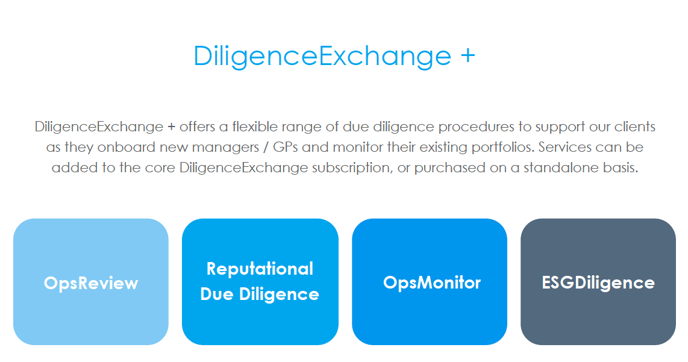

DiligenceExchange+

With core portflio-wide diligence data and analytics established, investors can then layer on additional services taking a risk-based approach to determine which positions will require which services, dependent upon the allocators internal diligence policies and risk assessments.

With Castle Hall, investors can conduct consistent, evidenced and auditable due diligence across all external asset manager relationships - irrespective of asset class.

Since 2006, Castle Hall has worked with institutional investors, fund of funds, family offices and endowments and foundations worldwide to conduct operational due diligence on their behalf.

For more information please visit https://www.castlehalldiligence.com/opsdiligence or Contact Us to speak with a member of our team.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.