DiligenceExchange is a new model for due diligence

The Industry Utility for Due Diligence

As ODD has become a more mature discipline, it is clear that the “first 50%” (or more!) of each ODD review is the same for all investors. Data points such as the manager’s corporate structure, the fund’s expense ratio or the biography of the compliance officer are needed by all allocators for every ODD review.

DiligenceExchange is a utility where managers and investors use the same framework to share core information in a standard format, bringing much needed efficiency to the industry ODD workflow in our Covid impacted world.

Data and Verification

DiligenceExchange starts with OpsData, Castle Hall’s online diligence data pack. OpsData presents key data points across the investment manager, the fund, and the manager’s control environment.

Castle Hall then conducts our own due diligence work, including “trust but verify” anti-fraud checks such as service provider verifications. We look at the data to analyze 200 analytical risk factors, and prepare a summary narrative to give a clear overview of how the manager and fund are structured and operate. You can also access our comprehensive, fully encrypted data room, further speeding the diligence process.

Access Information on Hundreds of Managers

Investors who are DiligenceExchange subscribers receive 100% coverage of their third party manager list, powering portfolio wide analytics. Subscribers also receive access to our broader DXC library, containing data on more than 500 managers and 1,000 funds, simply by connecting with each asset manager, LinkedIn style.

Data. Analytics. Insights.

DiligenceExchange introduces a new level of portfolio and peer group analytics. DiligenceExpress clients receive full coverage of all external asset manager relationships, enabling portfolio statistics to be run across 200 different analytical factors. How many of your managers do not have a dedicated chief compliance officer, have a related party broker dealer, have related / married employees (nepotism) or have a seed investor relationship?

Then, DiligenceExchange benchmarks allows investors to compare individual funds, and their overall portfolio, against Castle Hall's aggregate peer group. Tangible data introduces new avenues for due diligence, enabling investors to benchmark their portfolio against the observed practices of the largest due diligence peer group available in the industry.

And - DiligenceExchange peer groups can incorporate both operational due diligence and manager and strategy ESG information, adding further dimensions to manager analysis in our new investment environment.

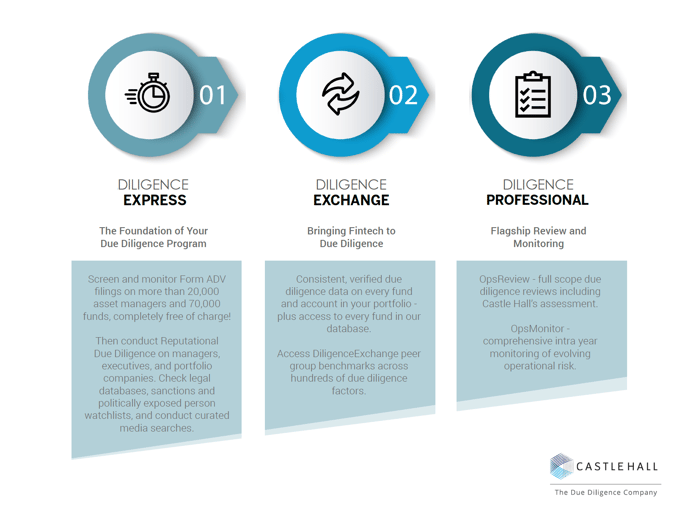

Learn more about Castle Halls 3 Steps to Effective Due Diligence.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.