DD 3.0 is a new era in due diligence based on four pillars: 1) Real-time Monitoring, 2) Multi Asset Class, 3) Risk-Based and 4) FinTech

What defines Due Diligence 3.0?

What defines Due Diligence 3.0?

Real Time Monitoring, Not Snapshot Reports

Traditional ODD has focused on a schedule of in person diligence meetings, with the output of each ODD cycle being a report memorializing information gathered during each meeting. This process is then repeated every 1-3 years.

Diligence 3.0 introduces a new operating model: the foundation of an effective ODD program is now an active, real time monitoring program, where the annual onsite visit is just one component of a far broader toolbox of diligence procedures.

Multi Asset Class

Operational Diligence should be applied across all third party asset manager relationships, not just hedge funds. Investors focused on governance, risk and compliance, now require consistent operational risk information across all fund and account holdings.

Risk Based Approach

Operational risks for mutual funds, long only managed accounts, private equity funds and real estate investments are very different as compared to a traditional hedge fund. Different diligence procedures should be adopted to reflect different asset classes.

FinTech

Just as hedge fund managers no longer use Excel for accounting, ODD no longer relies on word processed meeting reports. Technology has become critical to process ever increasing amounts of public and private information. Systems, bandwidth to curate data, and quality reporting and dashboard capabilities are vital to give asset owners an effective view of portfolio risks.

Due Diligence Policy

Finally, Due Diligence 3.0 is aggregated within a due diligence policy. At each stage of the investment process - screen, onboard and monitor - an asset owner due diligence policy establishes the level of due diligence to be undertaken. An effective policy considers the inherent risk of the asset class and fund structure; the manager specific risk; and the materiality of the investment.

Visit our Due Diligence University to download our Due Diligence 3.0 white paper and other resources, or contact us to learn how Castle Hall can help allocators build and implement risk-based due diligence policies and programs.

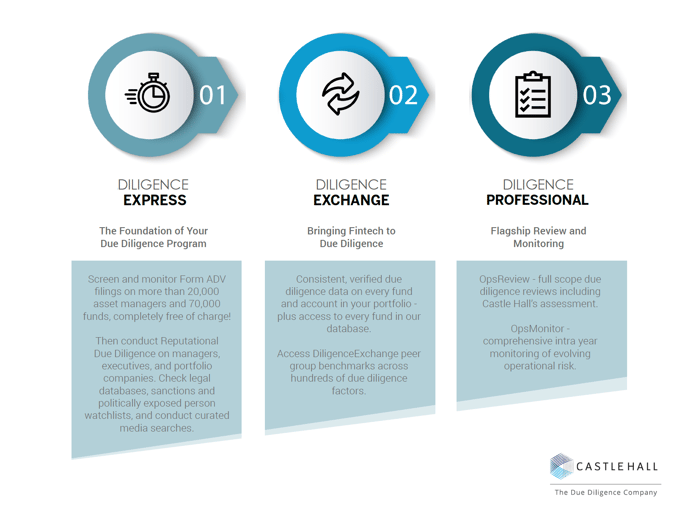

Learn more about Castle Halls 3 Steps to Effective Due Diligence.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.