Castle Hall has identified four themes from the Wirecard debacle which are relevant to the asset management industry.

The implosion of Wirecard is one of the most stunning corporate failures in recent years. The high flying company was the prestigious symbol of

corporate Germany’s pivot to fintech and a darling

of the EU technology industry. In 2018 the firm

joined the 30 companies in Germany’s DAX stock index with a capitalization of €25bn, with the fintech payments processing company symbolically replacing “old economy” Commerzbank. Now Wirecard has the reputation of being the only member of the DAX ever to go into liquidation.

Castle Hall has identified four themes from the Wirecard debacle which are relevant to the asset management industry. As investors conduct due diligence, be it on hedge funds, private equity, real estate, infrastructure or long only funds, Wirecard provides valuable insights which can be applied to our own industry.

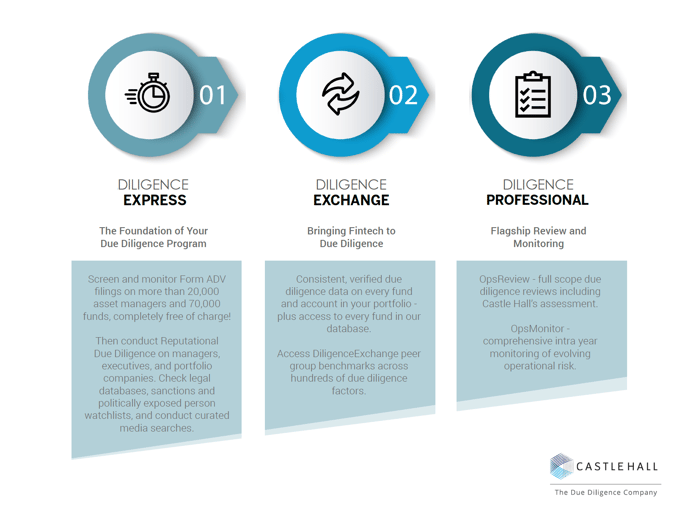

Visit Castle Hall's Due Diligence University to download our Wirecard whitepaper and other resources, or contact us to learn how Castle Hall can help allocators build and implement risk-based due diligence policies and programs.

Learn more about Castle Halls 3 Steps to Effective Due Diligence.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.