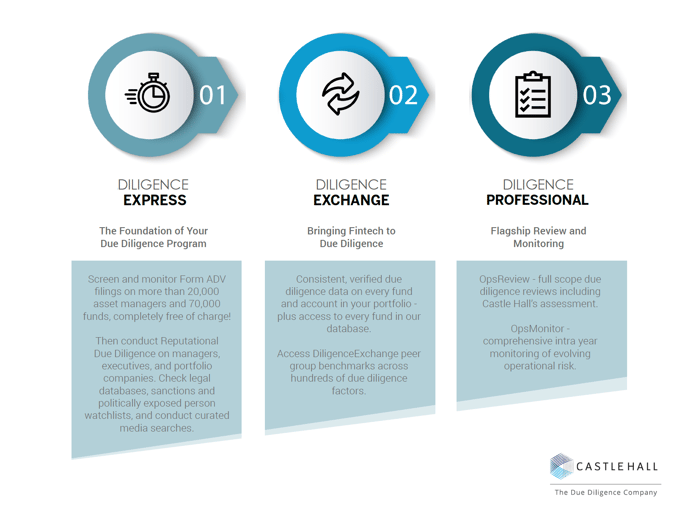

OpsDiligence® offers a comprehensive suite of diligence tools, across 3 steps to implement a risk-based diligence program.

Due Diligence. Solved.

Since 2007, Castle Hall has worked with institutional investors, fund of funds, family offices and endowments and foundations worldwide to conduct operational due diligence on their behalf.

Powered by DiligenceHub, our award winning online diligence platform,

OpsDiligence® allows in house diligence staff to move up the value chain. Using Castle Hall to gather core diligence data, internal staff can provide oversight, focus on exceptions, and engage with managers in higher quality discussions.

Step 1 - DiligenceExpress: Part of our next generation DiligenceHub portal - DiligenceExpress has two service elements related to due diligence of publicly available information - DiligenceExpress Form ADV Free and DiligenceExpress Reputational Due Diligence.

- DiligenceExpress - Form ADV Free allows users to efficiently screen and monitor Form ADV filing information on any asset manager registered as an investment advisor with the US Securities and Exchange Commission. Learn more about DiligenceExpress Form ADV Free.

- DiligenceExpress - Reputational Due Diligence ("RDD")provides rapid, cost effective validation of manager reputational risk - across regulatory filings, legal databases, sanctions and politically exposed person watchlists. Each RDD profile also includes extensive media searches across web, social media and premium news sources, including the Wall Street Journal.

Once invested, RDD monitoring provides daily updates when your managers are "in the news" - or in court.

Learn more about Reputational Due Diligence.

Step 2 - DiligenceExchange: DiligenceExchange links investors and managers to create new efficiencies in the diligence process.

- Managers benefit from a standardized, structured diligence process accessed by multiple clients and prospects.

- Investors benefit from Castle Hall's detailed, documented diligence, which allows in-house staff to move up the diligence value chain. Instead of report writing and spreadsheet filling, investors should be focused on high value questions, exceptions and follow ups. These are the material diligence issues which impact the investment decision.

- Overall diligence timelines are significantly accelerated, especially for new allocations.

Learn more about DiligenceExchange.

Step 3 - DiligenceProfessional: Castle Hall's suite of DiligenceProfessional services incorporates our traditional deep dive OpsReview and ongoing OpsMonitor services, as well as our ESG, Cyber and Investment Risk Diligence solutions.

- Learn more about DiligenceProfessional OpsReview

- Learn more about DiligenceProfessional OpsMonitor

- Learn more about ESGDiligence

- Learn more about CyberDiligence

- Learn more about RiskDiligence

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.