Castle Hall believes that due diligence is long overdue for a fintech makeover.

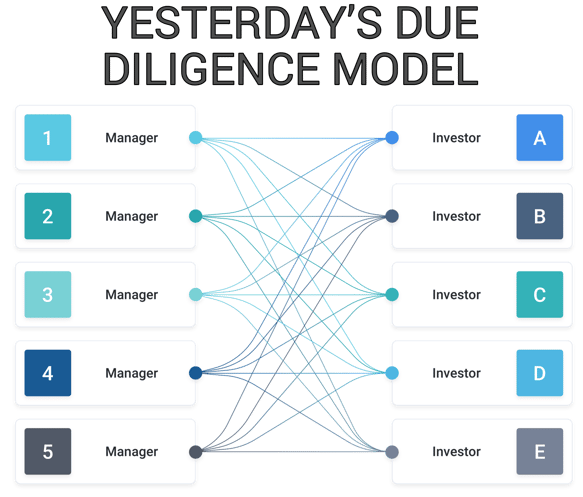

Every investor has higher value questions, specific to their organization, which influence their investment decision. But core diligence questions - the manager / GP's corporate structure, systems used, the compliance officer’s bio - are the same for all allocators. Multiple investors asking for the same information, but in slightly different ways, simply adds expense and delays the investment process for all sides.

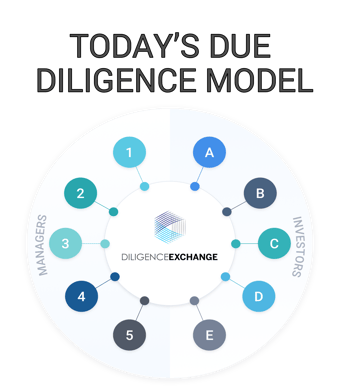

DiligenceExchange ("DXC") enables managers and investors to use the same framework to share core reference data, needed as the “first 50%” of every due diligence review, in a standard format.

For investors, DiligenceExchange provides consistent, independently verified due diligence, available for every manager and fund in a portfolio. For investment managers, Castle Hall saves time by enabling the manager to work with our diligence team on behalf of multiple investors.

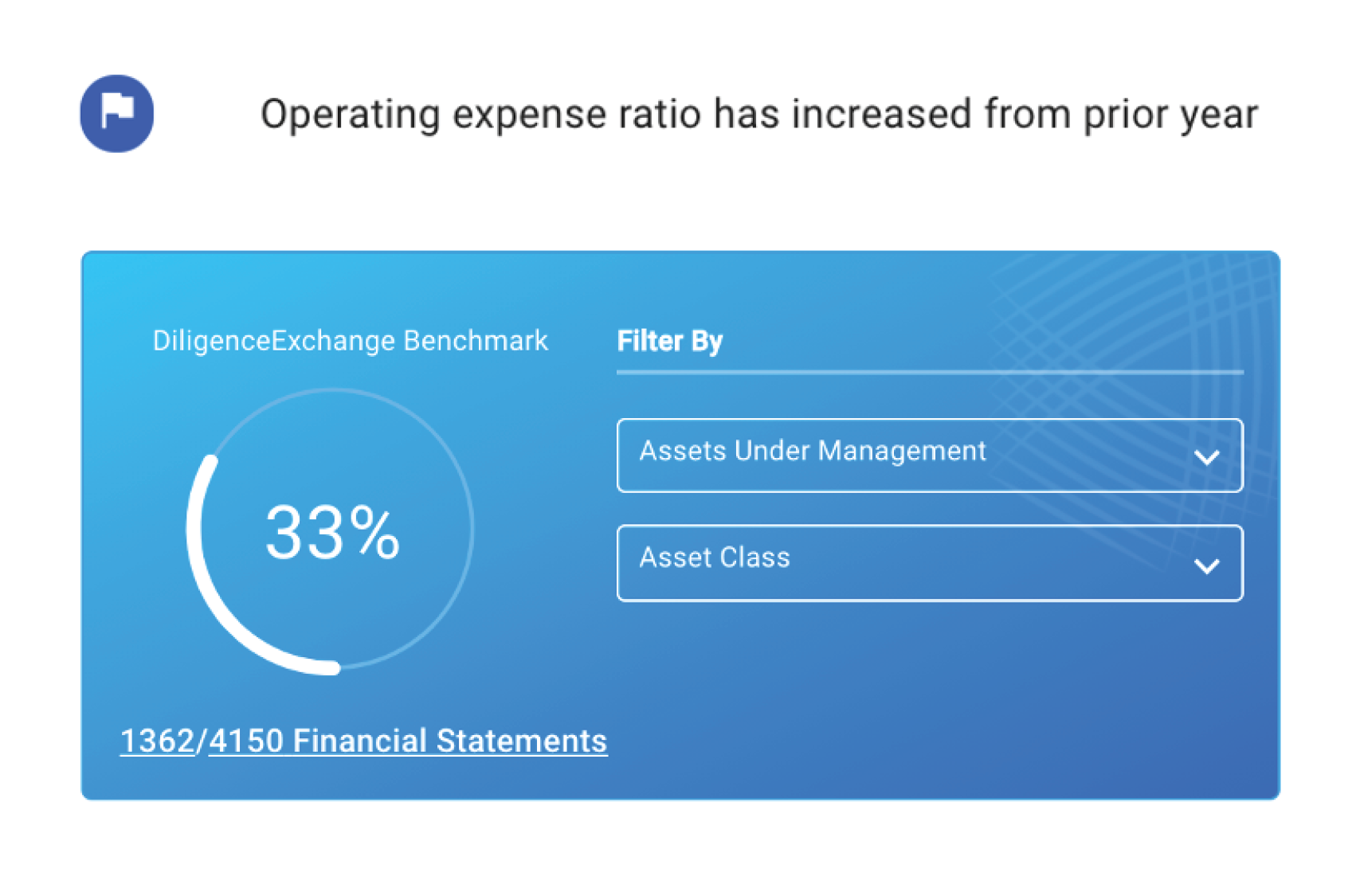

DXC Benchmarks deliver - at last - evidenced data about our industry. And that drives better outcomes for both investors and managers.

Chris Addy

Castle Hall CEO

Asset Managers who join DiligenceExchange work with Castle Hall to prepare a DiligenceExchange Transparency Report. Each report presents key data points across the investment manager, the fund and the manager's control environment in a standard format, comparable across all funds and accounts.

Importantly, DiligenceExchange is not just a web DDQ platform which simply transfers manager supplied information to investors. Castle Hall conducts our own due diligence work, including "trust but verify" anti-fraud checks such as service provider verifications. This means that data included in each DXC Transparency Report has been externally validated.

For asset managers, DiligenceExchange brings overdue efficiency to the due diligence process, delivering a consistent, verified diligence package to investors. For investors, DiligenceExchange Transparency Reports enable in house teams to move up the value chain to focus on high value questions which impact the investment decision - not core data gathering and verifications.

And the best part - DiligenceExchange Transparency Reports are free of charge to investors.

DiligenceExchange Premium gives investors access to Castle Hall’s DXC library of diligence reports on more than 2,000 funds, which is the industry’s largest due diligence database. Content includes both data submitted by asset managers who elect to prepare DXC Transparency Reports, as well as data gathered as part of our broader diligence coverage. Castle Hall works on behalf of more than 150 global investors, meaning our diligence footprint includes reviews of hundreds of the industry’s premier asset managers each year.

DiligenceExchange Premium subscribers can also request new DXC reports on any other manager and fund, ensuring that Premium subscribers have 100% coverage across all their investments. DXC is not limited to a typical consultant's existing coverage list.

DiligenceExchange Premium reports add valuable analytics to the core DXC reference data set.

Montreal

1080 Côte du Beaver Hall, Suite 904

Montreal, QC

Canada, H2Z 1S8

+1-450-465-8880

Halifax

84 Chain Lake Drive, Suite 501

Halifax, NS

Canada, B3S 1A2

+1-902-429-8880

Manila

Ground Floor, Three E-com Center

Mall of Asia Complex

Pasay City, Metro Manila

Philippines 1300

Sydney

Level 36 Governor Phillip Tower

1 Farrer Place Sydney 2000

Australia

+61 (2) 8823 3370

Abu Dhabi

Floor No.15 Al Sarab Tower,

Adgm Square,

Al Maryah Island, Abu Dhabi, UAE

Tel: +971 (2) 694 8510

Copyright © 2021 Entreprise Castle Hall Alternatives, Inc. All Rights Reserved.

Terms of Service and Privacy Policy